Financial Focus: Corona Virus, Pensions, Health and Wealth

Pensions – which type do you have? If in what is commonly known as “drawdown”, which many of you will have if you are making use of the pension freedoms we have today, have you taken steps to protect your investment?

I attended a two full day virtual conference recently, and amongst other speakers, heard the views of Mark Carney (former Governor of the Bank of England), John Glen MP and Sir Steven Webb. The conference was interesting, informative and very much based on the issues of today whilst considering the future and steps to be considered.

You may recall the name Steven Webb, former Minister of State for Pensions. He then worked with Royal London and more recently is a partner in a law firm. Listening to Steve speak reminded me of an article he wrote, and I found myself considering all the various possibilities and issues that could arise, some of which I discuss today.

Pensions, whether personal pensions currently invested for growth, or in drawdown and invested for growth and income, require you to be mentally capable, even if you use an adviser or self-invest.

It is important to consider what could take place if you were incapacitated with, for example, a longish hospital stay or worse still, becoming mentally incapable. This could happen simply with a fall, so do not kid yourself that it only applies to those approaching or in older age groups. How do you manage your pension then?

What about Scammers? I see police reports on a regular basis which tell us Scammers are busy and often successful, utilising highly convincing techniques. Pensions are now managed late into our senior years, however cognitive decline hits us all at some time or another where we are just not as sharp as we once were.

Do you have contingency plans in place? Do your parents, your friends? Pass this on if not!

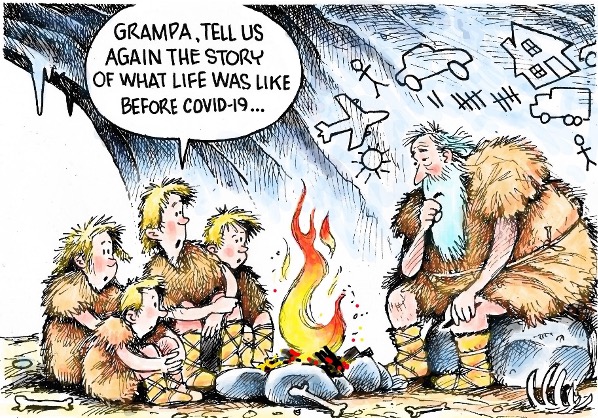

We have seen with Corona virus how life can suddenly change without warning. It would have been unimaginable just a few months ago not to be able to attend a family funeral or be at a loved one’s bedside. Much in life is unimaginable, and usually takes place quietly without effecting the entire world, but things happen none the less. Contingency plans or a plan B is important to protect yourself and your loved ones.

Please do not procrastinate and ignore this decision-making process and then find it may be too late.

Plan ahead – draw up Lasting Powers of Attorney. Do not leave your finances (or your personal needs and health) to chance or slow bureaucratic processes when by acting now, you are able to ensure matters are dealt with by those you trust.

Written By: Jacqueline Lee-Lis LLB (Hons), APFS, EFP Chartered Financial Planner | European Financial Planner

www.financialobserver.co.uk

Please note, this article contains general information only and is not to be construed as advice for any personal planning.